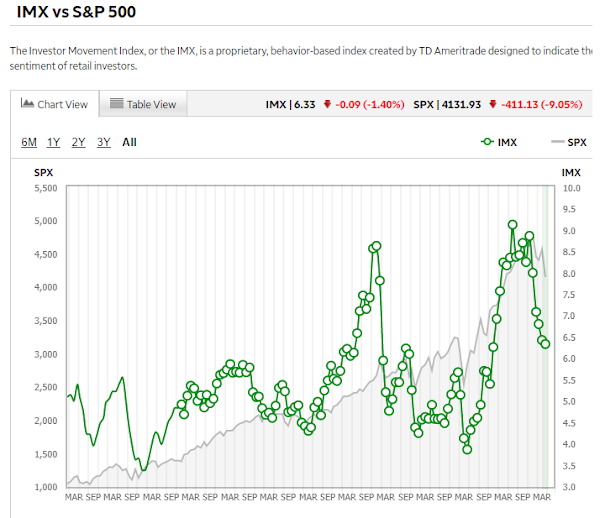

There are some indexes that track investor dollars. One is the IMX from TD Ameritrade. It shows their customers are more bullish then they've been most of the past 5 years. There was a blow-off in sentiment in December 2017. Within a month the market made a short-term top and a week later was Volmageddon. Another peak was in June 2021, four months after the ARKK-growth complex had peaked and about six months before what is now looking like a major bull market top. Aside from those blow-offs, current dollar-based action looks bullish relative to the prior years.

That comports with what I've witnessed and heard from bulls in real life. They didn't think and may still not think this is a bear market, they haven't really sold off assets and gone to 20 to 40 percent cash or higher. Rather they're bearish the same way they were bearish in prior corrections. They expected the market could drop, but have a buy-the-dip mentality that has become don't-sell-the-drop. They might be extremely bearish, but don't think it'll last more than a few weeks before the Fed will bail them out or it will naturally rebound. Most watched all the way down and are only now taking action or considering it.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)

No comments:

Post a Comment