December 2021: Inflation Bu Hao, Very Bu Hao

If you want to know why I think inflation can wreck stocks fast, here is the real earnings yield on stocks and the 46 percent bear market from 1973 to 1974 and the bear market low of 1982 and the fact that today's earning yield is lower. Now you know why ARKK holdings have been annihilated. Stocks with no or low earnings, with a lot of hype about back-loaded growth get traded like a 30-year treasury bond. The whole market is devaluing in real terms and investors are still bidding prices up on an inverted assumption about the direction of prices under higher inflation. I can't imagine a better setup with reality and assumptions so completely divorced.What I was talking about for a couple of years now, and was shorting ARKK-type stocks for in 2021, and why I turned very bearish at the end of 2021, happened. Rising interest rates crushed stock valuations. Stocks were wildly overvalued such that it didn't much matter if inflation or deflation came next, but inflation and higher interest rates is what did it. Bonds were pummeled this past week, breaking through support lines. Conversely, yields are at new highs.

In April of this year, I posted: RIP Bull Market, QT is Here. The S&P 500 Index was 16 percent higher at 4500 that day.

In December 2021, I wrote: The Bear Pill, a look at some technical reasons for a bear market via sector performance.

At the end of November 2021, I wrote a long post: This Might Be A Big One

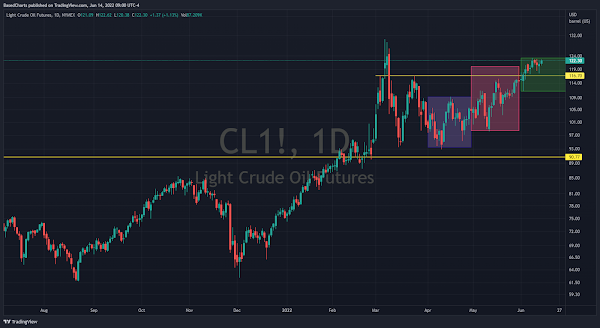

All that said, here's my basic sense of it. One, coronavirus is bullshit. It's a distraction. There's a political and economic disaster unfolding because of societal responses, but doing nothing would have been the smarter move. Between the central banks and stimulus on one side and government lockdowns and vaccine passports on the other, this is the greatest policy alligator jaws in history. One hand is driving financial assets skyward, while the other hand sledgehammers the economy's foundation. Almost every policy is destructive. There will be a supposed boom caused by a transition away from carbon energy...but the whole process is expensive and makes energy more expensive to boot. There's no transition, it'll be a never-ending decline unless countries go big on nuclear power.Is the bear market over? No, but I wrote this seven months ago. That was the time to realize rising interest rates and inflation would kill stocks, if the collapse of stocks found in funds such as ARKK didn't tip you off. Instead, "the market" realizes this in June 2022, when the 10-year and 30-year bonds are at or near decade lows, in the very week that the Federal Reserve will start implementing QT in size and when it might surprise with a higher pace of rate increases than expected. All the clueless bulls who held down to here thought the problem was the Fed tightening, now they want the Fed to tighten because they realize inflation is the problem. It will all come down to bonds and crude oil. If they stay on trend, the stock market can go lower. I think markets are approaching the point where continuation of these moves will trigger an economic shock, and that will cause crude and interest rates to drop. Short-term, a reversal in these trends along with the recent plunge in stocks would set up conditions for a powerful technical rally. I can't time it well, not my skill set. I can only say the window for a tradable bottom is open and may have been hit on Monday.OK you say, that's all well and good, but "the Fed." You have me there. The Fed bailed things out in March 2020...or did they? Maybe people realized their insane panic was overdone and markets were due for a bounce? Maybe the stimulus had more to do with it than the Fed? Maybe not, you can believe in the Fed if you want for this exercise, but I believe that is hazardous to your health. When we're "not fighting" the Fed, we're betting on the herd following the Fed. It has worked for 40 years. The Fed can't actually do anything when push comes to shove though. And I think the pushing and shoving is about to begin. To steelman the inflation argument, I'm going to grant you that the Fed will directly buy stocks in the next bear market or panic. They're going to buy ES or SPY or something. Stocks are going to experience a vertical rebound. What's going to happen to the U.S. dollar? Tank? OK, then bond yields are going to rise right? No? The Fed will buy all bonds out to 30-year too? Corporate bonds? Junk bonds? OK, they will buy the whole market. What does that leave the market? The crypto guys are excited. But how about crude oil? Natural gas? Wheat? Gold? If all the speculative activity unleased in $100+ trillion global bond and equity markets gets funneled into the far smaller commodities markets...that's going to cause economy-crippling inflation. Many predict this and it's perfectly logical. I have no beef with this forecast in its construction, only with the probability of it happening and the timing. I don't think the Federal Reserve will do it.

I don't think it will be politically acceptable. Buying stocks directly will trigger a populist revolt. More technically, I predict that before the above scenario can really get going, oil will quickly outperform the S&P 500 Index, maybe within days or weeks. A political revolt will begin seemingly overnight, a bond market panic, a currency market panic, and society will fast forward to the end of the inflation. The March 2020 intervention worked because oil fell below $10 per barrel, people were genuinely panicked and they didn't know what to expect. High inflation usually proceeds like the boiling frog analogy because the public has political and financial tools for stopping the inflation. People have to believe it works for it to continue. The Fed has no more leash for inflation now, not that I see. The public knows how it works. As I sometimes exaggerate, if the Fed tries to repeat what they did in March 2020 or goes bigger, I will YOLO my account on crude oil. I don't think I'm alone in having this trade idea stored away in the back of my mind. Traders, speculators and investors will front-run the inflation next time, bypassing stocks like Tesla for crude, copper, gold and silver. If crude oil makes a new 52-week high before the S&P 500, let alone a new all-time high, there will be riots at the headquarters of the Federal Reserve.

To summarize and bring this to a conclusion: if we eliminate the outlier outcomes of total deflationary or hyperinflationary collapse, the most likely scenario involves some type of inflationary policy that kills financial assets. The bond vigilantes will return, or maybe they will return in the form of crude vigilantes. The market will do the opposite of what the central banks want, forcing the central banks to stop. If the economy goes down the tubes, the Fed and USG will save it, and they will sacrifice the stock and bond markets if necessary. In relative terms, which allows for high inflation, stocks are at a point that won't be reached again for a generation. Maybe our lifetimes. Since I believe all speculation will be hit, crypto should also collapse. It's possible everything including gold collapses the moment the Fed signals no more inflationary policy. That, ironically, may be what allows them to unleash what will become hyperinflation.

Bear market rallies of 20 percent are common and can be much larger in larger-scale (in time and price) bear market such as the Nikkei after 1989. A run towards SPX 4100 is a 10 percent rally from current levels. A bounce of 20 percent takes it to 4500, all the way back to early April levels. I doubt a bounce would go that high, but I'll worry about targets once the rally gets underway.

Finally: this is a bottoming process. The market could go lower, but whatever happens, it will probably bounce around for awhile before moving higher. The first strong move of this rally is probably days to weeks away. The main takeaway is the easy short money has been made. VIX is higher and risk of a reversal is rapidly rising. It's time to be taking profits and thinking about going long, or sitting out a rally and focusing on re-entering short positions later.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)

No comments:

Post a Comment