The October PPI report was bullish for stocks. The market should love than news and run higher this week, but there are signs of weakness. I was caught wrongfooted opening short positions yesterday, but I might have been early instead of wrong about the rally completing.

The exhaustion I saw in the market yesterday was wiped out by the morning’s response to the PPI. Most people are not looking at China and other data sets showing the clear tilt into deflation underway and more oncoming in 2023 once housing data trickles through. At least through the PPI release, the market is still viewing falling inflation as bullish.

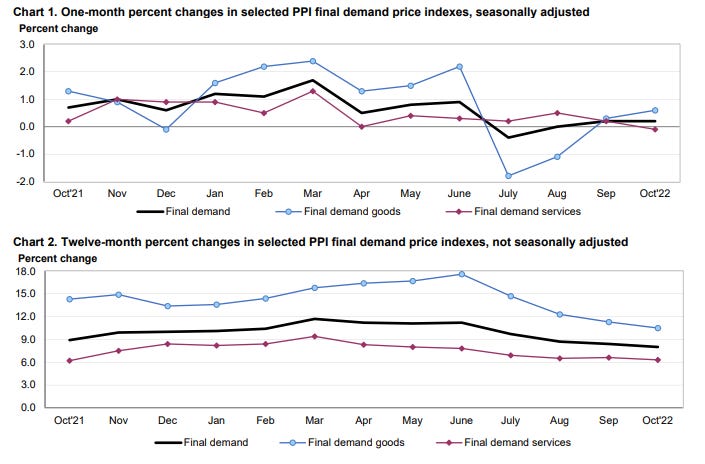

The core PPI services segment went negative in October.

There’s one potential paradox: speculators have been bidding up commodity prices in response to lower inflation readings. Will that continue? Today’s initial response was a jump in commodity prices that quickly reversed. It will be telling how this plays out today. If copper and oil continue sliding, it may indicate the market has started realizing the downturn in prices and slowing pace of Federal Reserve rate hikes might not be bullish.

Stocks reacted far more positively because there’s no sign of recession yet. Falling commodities without a recession would be positive for GDP growth, consumer spending and limit Federal Reserve rate hikes. It would be a move back towards the “Goldilocks” economy that stocks love.

If instead stocks and commodities start sliding, it will be evidence the market has moved beyond inflation worries and started on deflation worries.

Yesterday I opened a bunch of short positions having seen exhaustion on the tape. I’m going to be underwater at the open, but notice the line on the NQ chart. I have two resistance lines on the NQ at 12100 and 12200. Right here, my thinking is to add more shorts at 12200 if it can get there, but cut loose all the short positions above.

No comments:

Post a Comment