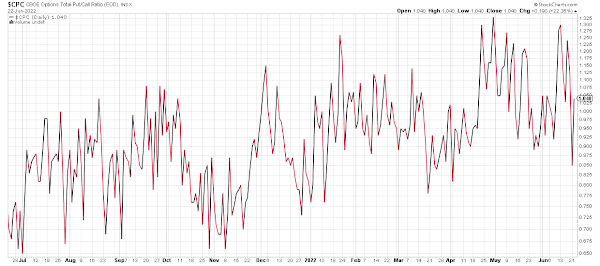

Yesterday, I saw a post on social media showing put options at a local low. That has been a sign of rallies losing steam lately. The amount of puts rose yesteerday though.

As you can see from the chart there has been an uptick in put buying this year, which puts a local low in context. The put-call ratio can go much lower in a significant rally, perhaps even reset.

Today, I saw this:

ZH: Bears Are Taking Over The Options Market

the 10-day moving average of put options traded in the US stock market - a gauge of speculative downside protection bets - has pushed above the equivalent for bullish calls for the first time since 2020, according to data compiled by Bloomberg.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)

No comments:

Post a Comment