What is embroiling Europe is deeper than a political crisis – it is approaching what can be called a crisis of legitimacy for the ruling elite. This can be thought of as a metaphysical event that precedes political upheaval, the latter being merely confirmation that such a crisis has taken place. Legitimacy is, of course, a rather nebulous concept, and it defies objective measurement.It was a good run, but when you're destroying nuclear power plants and running 6 percent deficits to prop up your Potemkin economy and financial markets, the reaper is right around the corner.Ruling classes throughout history have always advanced various claims about their own legitimacy, without which a stable political order is impossible. In tracing the contours of the current crisis, it’s important to establish what exactly the claims Europe's technocratic elite have put forth and how they are becoming increasingly difficult to believe.

Ostensibly, the EU’s ruling elite has staked out the green transition as its raison d’être. They claim to have the mandate, vision and competence to see it through and have set clear targets to measure their success.

2024-04-22

Fourth Turning Has Arrived: Adios Western Ruling Class

2024-04-21

2024-04-03

Immigration Restriction On the Ballot in Switzerland

The Swiss People’s Party submitted 114,600 signatures to the federal chancellery in Bern on Wednesday. It demands that a new article on “sustainable population development” be added to the constitution.According to the initiative, the population of permanent residents must not exceed ten million people before 2050. The government should then set a limit based on the birth rate. If 9.5 million people live in the country before 2050, the Federal Council and Parliament would have to act.

For example, temporarily admitted persons would then no longer be able to obtain a permanent residence permit. Family reunification is also to be restricted. International agreements with exemption or protection clauses would have to be renegotiated. If all this is not enough, the Agreement on the Free Movement of Persons with the European Union would have to be cancelled.

2024-01-11

FT Admits Govts Have Been Scamming Western Voters on Immigration

The EU collectively, which fears losing the global competition for high-productivity workers, is similarly trying to attract skilled non-EU migrants with a “talent pool” scheme aptly nicknamed “Tinder for jobs”. But a wave of fervently anti-immigration candidates are high in the polls ahead of the European parliamentary elections this year. If Trump is re-elected in 2024, his repulsive comments about undocumented immigrants poisoning America’s blood will also create expectations of a general clampdown.It has never been about high skill immigration because they've been letting in wave after wave of welfare-using migrants. High skill labor doesn't go on welfare. The average immigrant into the West is using welfare at much higher rates than natives.Perhaps, particularly in the UK, the tough-on-refugees, soft-on-workers game is up. Audiences have worked out the trick and are heckling the conjuror. But if the alternative is taking the risk of actually being honest with voters, governments might think it’s worth trying the well-practised ruse once again.

2024-01-10

2024-01-09

2023-12-19

Western Ruling Class Starts Reaping the Migrant Whirlwind

For the past decade, Western ruling regimes pushed mass migration on a public that wanted immigration restriction. They iced out nationalist parties, calling them far-right, extremist and so on for desiring sane migration policies. After sowing the wind with this propaganda, they now reap the whirlwind. If they fail to tighten migration laws, the "far-right" wins. If they tighten migration laws, the "far-right" wins.

France seeks to break deadlock over controversial immigration law

The latest deal also introduces migration quotas, makes it harder for immigrants' children to become French, and says that dual nationals sentenced for serious crimes against the police could lose French citizenship.

2023-12-18

Every SARS2 Strain is Man Made?

A new Japanese paper claims all the SARS2 strains are manmade: JAPANESE SCIENTISTS FIND INDISPUTABLE EVIDENCE THAT ALL COVID VARIANTS ARE MAN-MADE

This has only dropped recently. Perhaps it will be debunked. I haven't seen anything yet. If not, this may never get the coverage it deserves.

2023-12-08

2023-11-16

Bin Laden's Letter to the American People

In the name of Allah, the Compassionate, the Merciful.From Usama Bin Muhammad Bin Ladin to the American people,

I speak to you about the subject of the ongoing war between you and us. Even though the consensus of your wise thinkers and others is that your time (TN: of defeat) will come, compassion for the women and children who are being unjustly killed, wounded, and displaced in Iraq, Afghanistan, and Pakistan motivates me to speak to you.

First of all, I would like to say that your war with us is the longest war in your history and the most expensive for you financially. As for us, we see it as being only halfway finished. If you were to ask your wise thinkers, they would tell you that there is no way to win it because the indications are against it. How will you win a war whose leaders are pessimistic and whose soldiers are committing suicide? If fear enters the hearts of men, winning the war becomes impossible. How will you win a war whose cost is like a hurricane blowing violently at your economy and weakening your dollar?

The Bush administration got you into these wars on the premise that they were vital to your security. He promised that it would be a quick war, won within six days or six weeks; however, six years have passed, and they are still promising you victory and not achieving it. Then Obama came and delayed the withdrawal that he had promised you by 16 more months. He promised you victory in Afghanistan and set a date for withdrawal from there. Six months later, Petraeus came to you once again with the number six, requesting that the withdrawal be delayed six months beyond the date that had been set. All the while you continue to bleed in Iraq and Afghanistan. You are wading into a war with no end in sight on the horizon and which has no connection to your security, which was confirmed by the operation of ‘Umar al-Faruq, which was not launched from the battlefield and could have been launched from any place in the world.

As for us, jihad against the tyrants and the aggressors is a form of great worship in our religion. It is more precious to us than our fathers and sons. Thus, our jihad against you is worship, and your killing us is a testimony. Thanks to God, Almighty, we have been waging jihad for 30 years, against the Russians and then against you. Not a single one of our men has committed suicide, whereas every 30 days 30 of your men commit suicide.

Continue the war if you will.

Palestine shall not be seen captive for we will try to break its shackles.

The United States shall pay for its arrogance with the blood of Christians and their funds.

Peace be upon those who follow right guidance.

Justice is the strongest army, and security is the best way of life, but it slipped out of your grasp the day you made the Jews victorious in occupying our land and killing our brothers in Palestine. The path to security is for you to lift your oppression from us.

2023-11-10

2023-11-02

Manipulation to the Max?

Still, until I see smoking gun evidence of fraud, it's an unverified claim. The markets are behaving as expected when there’s a relentless bid from retirement funds being invested in high risk securities through passive index funds, along with an endless bid from speculators who think the Federal Reserve’s number-one job is pumping the stock market.

After the bear market, firms such as Blackrock, Vanguard, Invesco and maybe companies offering 401k menus, the whole investment industry really, could be charged with fraud, criminal negligence and so forth. There won’t be any way to replace two generations of lost retirement savings, but all of these firms can be destroyed and their executives placed in jail. If this ends up being a bigger bust than 1929, expect a bigger response from government even if it is unfair, unjust scapegoating.

However. I saw this claim on Twitter:

If the Federal Reserve is manipulating commodity prices, it is engaged in criminal fraud. Everyone involved is committing criminal acts with no legal protection, only political cover if the current regime OK'd it. It is likely at the behest of the criminal regime in Washington, DC. If this is going on, and this is only a claim on social media, but at this point it wouldn’t shock given how the Federal Reserve has expanded its operations in the past decade. Nor would it shock considering all the criminal and seditious actions being taken by USG.

Widespread criminal activity at the heart of government and the financial system would be precisely the type of rot you’d expect ahead of or during a Fourth Turning. If the public ever move on from Trump, Kennedy and current outsiders, and found itself a real rival elite, and if such a man could win against a criminal regime willing to rig elections, he would become a defacto dictator for the simple reason that arresting most of the ruling class would be step one of any reform effort. Otherwise as with Trump, they would engage in seditious conspiracies to thwart any reform.

Moreover, they are building an authoritarian, fascist system fusing government power with corporate operations. The government is the iron hand of tyranny, corporations the velvet glove that carries out what is still currently illegal for government. It's like a turnkey operation for a would-be Pinochet.

The government doesn’t openly use all its powers because it would be unpopular at this stage. Probably not as unpopular as it should be. About a third of the country seems to be on board with fascism as long as it's against their enemies. When the depression is in full swing though, and if the public revolts for real, they will cheer a President who makes full use of the national security state against the current ruling class. He can use military tribunals to wipe them out, and his face will be added to Mount Rushmore. Such is the scale of coming events. That, or the bad guys win and consolidate power. They are already using state power against political enemies and jailing supporters of rival politicians. If they keep going, the USA turns into something like modern China with permanently manipulated markets with a fig leaf of private ownership and rigged elections acting as the veneer for a totalitarian state.

2023-10-15

2023-09-05

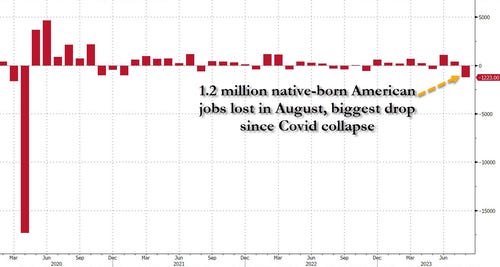

Replacement of American Workers by Foreigners Hits Extremes

Meanwhile, the number of foreign-born workers (i.e., immigrants) surged by 668K to a record 30.396 million

About 156 million people are employed in the labor force. About 1 out of 5 are foreigners and this isn’t counting illegal aliens who might run into the tens of millions. The total swung by 1.8 million people last month alone, or more than 1 percent of the workforce.

If an invasion of foreigners was good for the country, USG should be running massive budget surpluses as foreigners build companies and pay taxes. The opposite is the case: data from the Center for Immigration Studies shows foreigners use welfare at far higher rates than natives. Cities such as New York, Chicago and Los Angeles are now having political meltdowns over experiencing a small fraction of what Texas, Arizona and other border states experienced for decades. Many of these states were already on the brink of bankruptcy. They do not have the resources to deal with the problem.

It also isn’t really a result of busing from border states so much as the waves of illegal aliens finally overwhelming the United States. There isn’t enough housing, there aren’t enough doctors, there aren’t enough schools, there’s nowhere near enough money for tens of millions of new welfare cases adding to the burden of a rapidly aging society already going into inflationary-collapse over entitlement spending. If natives are quitting or losing jobs and being replaced with cheaper foreigners, they all qualify for welfare. The country is moving backwards, rapidly into Third World status.

Very short-sighted and clueless people think this is good for the country. It’s going to end up being good like atomic cornflakes, margarine and mRNA vaxxes. Unlike many problems, this one won’t get cheaper after people realize what happened. The country will first experience massive economic hardship. Only then, when natives suddenly cannot find jobs or have to take huge pay cuts amid rising inflation, or see their welfare benefits cut as is already happening in cities such as Chicago, will they realize they’ve been hoodwinked. Then we spin the roulette wheel and find out what form the dictatorship takes and how long it lasts. Even if its democratic, the man who emerges from this mess will rule as FDR and Lincoln did. Political enemies will be jailed., either the current regime hanging on or a new regime punishing the current one. Immigration will probably go negative for a time and then hit a number close to zero, staying there for a century or more.

The U.S. has been in similar situations before, but it was never pushed to this extreme. Foreign born population was high enough to warrant a major reduction or even near total ban on immigration back in 2000. Policy has gone in an extremist direction since then. The three prior periods: heading in the 1770s, the 1850s and the 1920s. Two out of three sparked wars and the third came ahead of World War II. Nothing good is coming in the short-term.