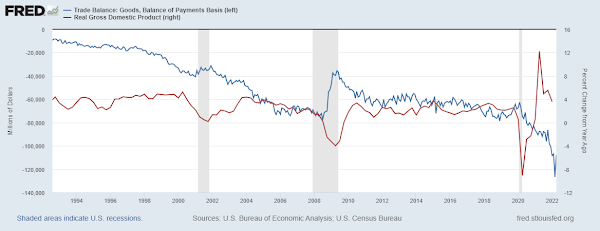

I've talked about how inflation is dollar bullish because Japan and Europe and China import commodities. For the U.S., if consumers buy less imported consumer goods because they have to spend more on food and energy, most of which is domestically produced, that is highly positive for the exchange rate (not the currency's intrinsic value) along with GDP.

Back in 2008, imports collapsed during the recession. All that did was hide the extent of the slowdown. If the economy doesn't repeat the 2008 scenario, then it is possible the plunge in imports already underway could keep GDP positive and avoid a recession print. That doesn't mean it still won't be revised into recession next year, but that is something that will depend on how crude oil behaves moving forward.

Finally, I have been banging on about oil all year and using CL as a cheat sheet for inflation, and here's David Rosenberg explaining it another way:This is a great tweet for all the conspiracy-minded people out there who think the markets are manipulated by the Federal Reserve and the government. What is the obvious play here? Kill the oil market and inflation slides to around 4 percent. Look at where oil was a year ago and where it will be "a year ago" in September. A decline of 30 to 40 percent in crude oil will eliminate most energy inflation, as long as the bottlenecks in gasoline, diesel and natural gas also ease. Not a guarantee, but probable if oil tumbles. The Fed is about to implement QT2 at the near-maximum rate that QT1 ended on. Crude oil fell 44 percent when QT1 hit the $50 billion per month maximum.Nothing is guaranteed, but there's a clear story for peak inflation if the crude price declines because signs of economic slowdown are everywhere. The Federal Reserve needs the guts to hammer crude oil with a tightening. They don't have the guts, but crude is already selling off on today's hot CPI report because the market expects the Fed will act more boldly. One bank already called for a 75 basis point hike. In sum, I see the 2022H2 trade of short energy as underway.

Finally, I mentioned long gold earlier. There is now a bullish engulfing candle on GDX. It has to close above $32.15 for this engulfing candle to hold, preferably it would close higher.

No comments:

Post a Comment