If the U.S. has it bad, Europe could become a wasteland. BOE Raises Rates by Most Since 1995, Warns of Long Recession (Archive link)

The Bank of England unleashed its biggest interest-rate hike in 27 years as it warned the UK is heading for more than a year of recession under the weight of soaring inflation. The pound fell.Europe is in far worse shape because of the Russia sanctions. The could alleviate price pressures by backing off the war, otherwise things will play out as they predict, but probably worse. Since the U.S. is already in recession, it isn't going to be helped by the UK and Europe weakening. Maybe the U.S. can recover sooner, or maybe China will as in 2008.The half-point increase to 1.75%, predicted by most economists, on Thursday was backed by eight of the central bank’s nine policy makers, who also kept up a pledge to act forcefully again in the future if needed.

“The committee will be particularly alert to indications of more persistent inflationary pressures, and will if necessary act forcefully in response,” Governor Andrew Bailey told reporters in London. “All options are on the table for our September meeting, and beyond that.”

The pound slid after the move, which was accompanied by warning that a UK recession will begin in the fourth quarter and last all the way through next year.

The BOE also boosted its forecast for the peak of inflation to 13.3% in October amid a surge in gas prices, and warned that price gains will remain elevated throughout 2023. That will sharpen a cost-of-living crisis that will see real disposable incomes fall more than at any time in around 60 years.

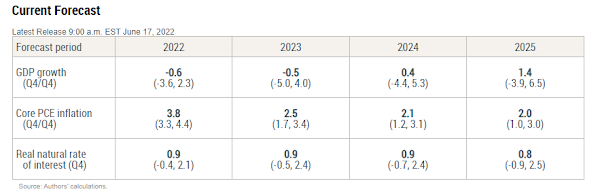

Here's the DSGE model. I disagree with their forecast because I doubt there will be two years like the past six months, a mild recession that goes on and on. Instead, it should have some point where things reach a peak. That said, the model also doesn't predict much growth after the economy bottoms out. The growth out of that recession is also expected to be mild, meaning it could take another year or two to get back to the prior peak of GDP. Looking at an economic downturn as the time to recapture prior peak, this could be the longest recession since the Great Depression.

For more of my thoughts on the economy, see It's Not a Recession. It's a Depression.

No comments:

Post a Comment